Notary Business Plan, Marketing Plan, How To Guide, and Funding Directory

The Notary Business Plan and Business Development toolkit features 18 different documents that you can use for capital raising or general business planning purposes. Our product line also features comprehensive information regarding to how to start a Notary business. All business planning packages come with easy-to-use instructions so that you can reduce the time needed to create a professional business plan and presentation.

Your Business Planning Package will be immediately available for download after your purchase.

- Bank/Investor Ready!

- Complete Industry Research

- 3 Year Excel Financial Model

- Business Plan (26 to 30 pages)

- Loan Amortization and ROI Tools

- Three SWOT Analysis Templates

- Easy to Use Instructions

- All Documents Delivered in Word, Excel, and PDF Format

- Meets SBA Requirements

Notaries survey number of important functions as it relates to the closing of large transactions given that they are able to confirm the identities of anyone that is signing a document. These individuals are able to testify in court as to what documents were signed by what individuals on a certain date and at a certain time. As such, notary businesses are almost always able to remain profitable and cash flow positive given that these services are needed for any type of transactional work. Most often these individual notary businesses have ongoing relationships with attorneys, business brokers, title insurance companies, insurance firms, and automotive businesses given that these businesses frequently require the notary is present when documentation is signed. One of the common trends within this industry is that a notary will operate on a mobile basis. Given that real estate closings, vehicle sales, and other large transactions occur in a number of different places – it is now very common for notaries to travel from place to place in order to render their services.

These types businesses enjoyed moderate barriers to entry given an individual must become a notary public before they are able to provide the service to the general public. This is usually a modestly complex process involves taking a test, receiving recommendations from other public officials, and submitting a bonding form so that in the event that something goes wrong the individuals are insured against errors and omissions.

The startup costs associated with the new notary business are very low given that once an individual receives their commission they are able to operate by simply just advertising their services to the general public. The gross margins for notary services typically range anywhere from 75% all the way to 100% depending on whether or not fuel costs are considered as part of the cost of goods sold for traveling to each location in which a notary as needed. Many notary public’s have also now taken to accepting credit cards as a form of payment at the time the transaction.

A notary SWOT analysis is usually produced in conjunction with both a business plan and a marketing plan. As it relates to strengths, notaries are almost always able to produce a positive income simply by being present at large-scale transactions. Barriers to entry are considered to be moderate given that it is a time-consuming process to become a notary public. The startup costs are very low and typically range anywhere from $1,000 to $10,000 depending on whether or not a vehicle is going to be acquired in conjunction with providing notary services. The demand for notaries does not wane even in times of economic recession as people are still going to carry out large-scale transactions.

Pertaining to weaknesses, anyone who has a clean background and is a competent person can become a notary. There are no educational requirements outside of a small class that is usually offered several times a year by most states. As such, one of the things that many notary publics do in order to remedy this competitive issue is to develop ongoing and continued relationships with a number of businesses that require notaries on an ongoing basis. Additionally, many notaries will engage in a broad-based marketing campaign in order to ensure that they are ably found by the public very easily.

As it relates to opportunities, many notaries will seek to operate their business in an agency capacity wherein they will receive ongoing orders for notary public services and will recruit a number of other individuals I can provide this service to the general public. This is really the only way that many notary businesses grow given that this is a specialized service that is not often needed but is decent enough where an individual can carry out this service from time to time. As such, it is imperative that the individual was expand the business is able to properly recruit additional people that work on behalf of the company.

For threats, this is one of the best things about this business is that there are very little ongoing threats outside of competitive issues. There is no risk of automation given that an individual human being must become a licensed notary public before they are able to provide the services. However, some states are now allowing for online viewing of documentation and identity verification. As such, it would be a smart business decision to have a notary service that allows for the online processing of documentation when applicable. Some states are beginning to allow this in order to reduce the cost associated with providing notary services.

A notary business plan should be developed if an individual is seeking a working capital line of credit for private investment in order to provide the services to the general public. This business plan should have a three-year profit and loss statement, cash flow analysis, balance sheet, breakeven analysis, and business ratios page. Given the low start up costs associated with a new notary business most banks and lenders are willing to extend a line of credit for small business loan without having to go through much of a large-scale loan application process. This is primarily due to the fact these businesses do not require much capital at all and once a person receives their commission as a notary public – they simply travel from place to place as needed. Usually, if an individual is seeking capital in order to start a new notary business now typically doing so for the acquisition of tangible equipment and working capital. As such, most financial institutions, lenders, and banks are willing to extend this credit given the high demand and large amount of tangible assets that are typically used with borrowed funds.

A notary marketing plan should be developed in conjunction with both the business plan and SWOT analysis in order to present to any third party how the business intends to generate customer base. For most, and as discussed above – most notaries aggressively engage in marketing their services to law firms, real estate brokerages, real estate agents, business brokerages, mortgage lenders, and automotive businesses that have ongoing needs for notaries from time to time. It should be noted that some third-party companies to employ a notary public in house but this is not often done. One of the fastest ways that a notary business can generate revenue is by establishing ongoing relationships with the aforementioned parties.

An online presence is also important for a notary business given that many people will use popular search engines such as Google, Yahoo, Bing, and AOL in order to find specialized local services. The cost of developing a website specific for notary business is very low given that there is nothing that is really needed outside of the description of services offered, the backgrounds of notaries, and a simple contact form that the individual can get in touch with the company very quickly. Generally, there is very little competition in any market for notary services so obtaining high rankings in search results is pretty easy once the website and business have been established for at least one year.

Many people also maintain a FaceBook page, Twitter account, and Google+ account in order to further expand the visibility of their notary operations. One of the nice things about maintaining a profile on popular social media platforms that sometimes people will ask their friends and family for a recommendation of services, like local notaries, and the business can be easily found this way. The cost associated with developing and maintaining this type of social media platform are either zero or very little depending on how much marketing the individuals going to do. As such, online marketing can be one of the most effective ways for receiving visits from the general public as the business is building its referral base among law firms and related entities.

A notary is going to be required in major transactions at all times. By virtue of law, these businesses are almost always able to have demand for their services on a year-round basis. Generally, notaries experience a significant uptick in the business during the spring months when more realistic closings are being carried out. One of the nice things about these businesses beyond their low barriers to entry and low start up costs is that they can be readily expanded as needed. By operating an agency capacity – a notary can aggressively expand this business so that it can have generate significant billable hours on a month-to-month basis.

1.0 Executive Summary

The purpose of this business plan is to raise $150,000 for the development of a notary and business services company while showcasing the expected financials and operations over the next three years. Notary, Inc. (“the Company”) is a New York based corporation that will provide notary and ancillary businesses services. The Company was founded by John Doe.

1.1 The Operations

As stated above, the business will render state based notary services to legal professionals, businesses, and individuals that need to have documents notarized. The business may also provide specialized preprinted legal forms to the general public if required by a client. The business intends to operate as an agency for independent notaries as well.

The Company will also recognize revenues from ancillary services such as ongoing large scale notary services for law firms and other organizations that have frequent notarization needs.

The third section of the business plan will further describe the services offered by the Notary.

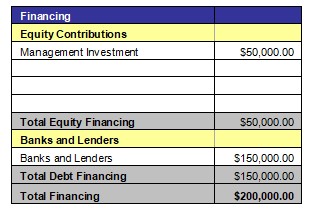

1.2 The Financing

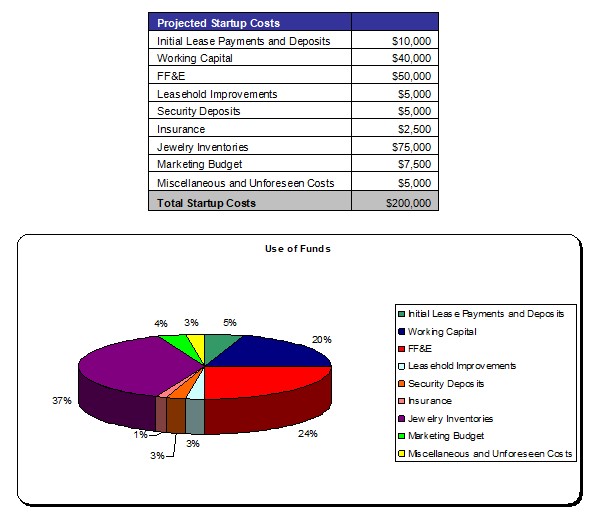

Mr. Doe is seeking to raise $150,000 from as a bank loan. The interest rate and loan agreement are to be further discussed during negotiation. This business plan assumes that the business will receive a 10 year loan with a 9% fixed interest rate. The financing will be used for the following:

- Development of the Company’s Notary location.

- Financing for the first six months of operation.

- Capital to purchase general office equipment.

Dr. Doe will contribute $25,000 to the venture.

1.3 Mission Statement

Management’s mission is to develop Notary, Inc. into a premier notary and business services agency within the New York metropolitan area.

1.4 Management Team

The Company was founded by Mr. John Doe. Mr. Doe has more than 10 years of experience as notary and business owner. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

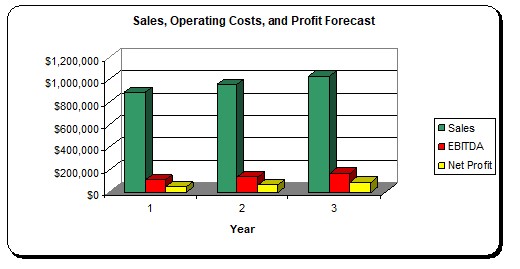

1.5 Revenue Forecasts

1.6 Expansion Plan

The Founder expects that the business will aggressively expand during the first three years of operation. Mr. Doe intends to implement marketing campaigns that will effectively target effected individuals, businesses, and law firms within the target market.

2.0 The Financing

2.1 Registered Name and Corporate Structure

Notary, Inc. The Company is registered as a corporation in the State of New York.

2.2 Use of Funds

2.3 Investor Equity

Mr. Doe is not seeking an investment from a third party at this time.

2.4 Management Equity

John Doe owns 100% of the Notary, Inc.

2.5 Exit Strategy

If the business is very successful, Dr. Doe may seek to sell the practice to a third party for a significant earnings multiple. Most likely, the Company will hire a qualified business broker to sell the business on behalf of Notary, Inc. Based on historical numbers, the business could fetch a sales premium of up to 2 to 3 times earnings.

3.0 Operations

As stated in the executive summary, Notary, Inc. will provide notarization services to law firms, businesses, and individuals that have notary needs. The business will also sell a variety of preprinted legal forms that will assist individuals with their ongoing legal filing needs.

All individuals retained by the business will be required to have an appropriate notary license granted by the State. The business will confirm this matter prior to hiring any associate notary.

4.0 Market and Strategic Analysis

4.1 Economic Analysis

This section of the analysis will detail the economic climate, the notary industry, the customer profile, and the competition that the business will face as it progresses through its business operations.

Currently, the economic condition as a result of the COVID-19 pandemic is rapidly improving. Interest rates have remained low, which has led to substantial improvement in the economy. Although there are issues with inflation, the US Federal Reserve has indicated that they are willing to adjust monetary policy to combat this issue. The economy is moving back towards normal at this time.

4.2 Industry Analysis

Within the United States, there are approximately 15,400 businesses that provide supportive legal services (which includes notary services). Each year, these businesses aggregately generate more than $11.6 billion of revenues while concurrently providing jobs to more than 100,000.

This is a mature industry and the expected growth rate is expected to remain on par with that of the general business economy.

4.3 Customer Profile

Management anticipates that the business will have a number of different clients including:

- Individuals with notary needs.

- Law firms that have substantial notary needs.

- Businesses that frequently file notarized business forms (especially among debt servicing and financial businesses.)

Among businesses and law firms, Management anticipates that these companies will generate $100,000 to $300,000 per year and will spend $1,000 to $2,000 per year with Notary, Inc.

4.4 Competitive Analysis

This is one of the sections of the business plan that you must write completely on your own. The key to writing a strong competitive analysis is that you do your research on the local competition. Find out who your competitors are by searching online directories. If there are a number of competitors in the same industry (meaning that it is not feasible to describe each one) then showcase the number of businesses that compete with you, and why your business will provide customers with service/products that are of better quality or less expensive than your competition.

5.0 Marketing Plan

Notary intends to maintain an extensive marketing campaign that will ensure maximum visibility for the business in its targeted market. Below is an overview of the marketing strategies and objectives of the Notary, Inc.

5.1 Marketing Objectives

- Develop an online presence by developing a website and placing the Company’s name and contact information with online directories.

- Implement a local campaign with the Company’s targeted market via the use of flyers, local newspaper advertisements, and word of mouth.

- Establish relationships with law firms, debt collection agencies, financial services firms, and other businesses within the target market.

5.2 Marketing Strategies

Mr. Doe intends on using a number of marketing strategies that will allow Notary, Inc. to easily target its demographics within the New York metropolitan area. These strategies include traditional print advertisements and ads placed on search engines on the Internet. Below is a description of how the business intends to market its services to the general public.

Notary, Inc. will also use an internet based strategy. This is very important as many people seeking local services, such as specialized legal support and notary services, now the Internet to conduct their preliminary searches. Mr. Doe will register the Notary with online portals so that potential customers can easily reach the business. The Company will also develop its own online website.

The Company will maintain a sizable amount of print and traditional advertising methods within local markets to promote the notary and legal support services that the Company is selling.

5.3 Pricing

In this section, describe the pricing of your services and products. You should provide as much information as possible about your pricing as possible in this section. However, if you have hundreds of items, condense your product list categorically. This section of the business plan should not span more than 1 page.

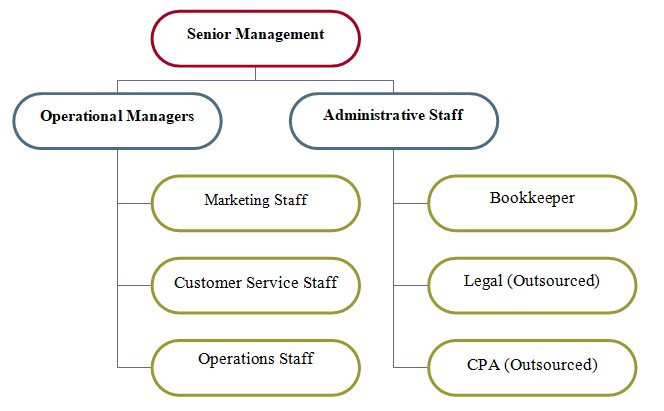

6.0 Organizational Overview

6.1 Organizational Chart

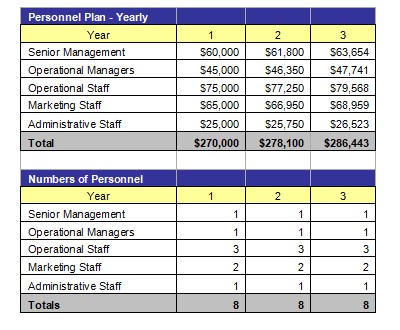

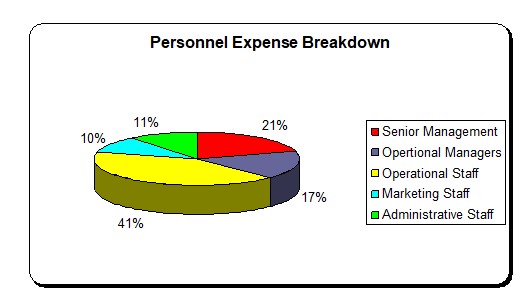

6.2 Personnel Budget

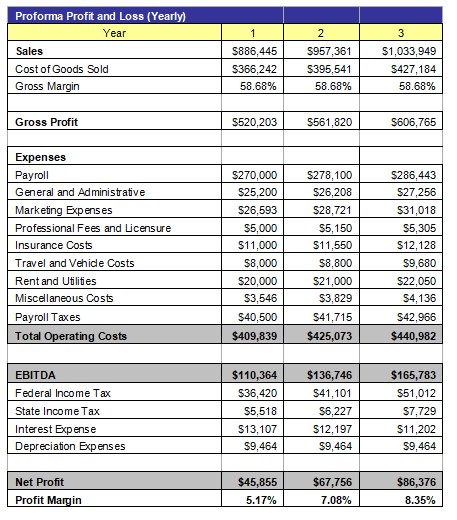

7.0 Financial Plan

7.1 Underlying Assumptions

The Company has based its proforma financial statements on the following:

- Notary, Inc. will have an annual revenue growth rate of 16% per year.

- The Owner will acquire $150,000 of debt funds to develop the business.

- The loan will have a 10 year term with a 5% interest rate.

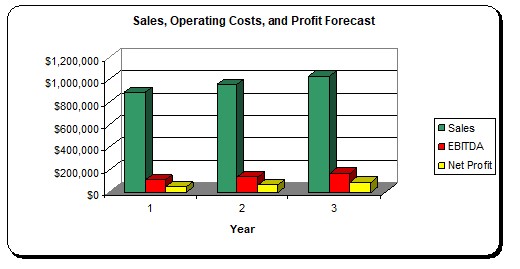

7.2 Financial Highlights

In the event of an economic downturn, the Company will not see a major decline in revenues. The demand for notary services remains static as people, businesses, financial service firms, and law firms require these services on an ongoing basis.

7.3 Source of Funds

7.4 Profit and Loss Statement

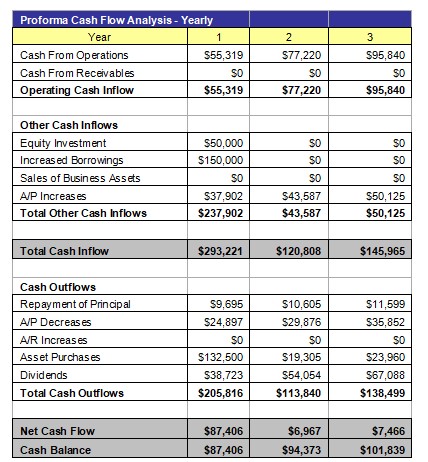

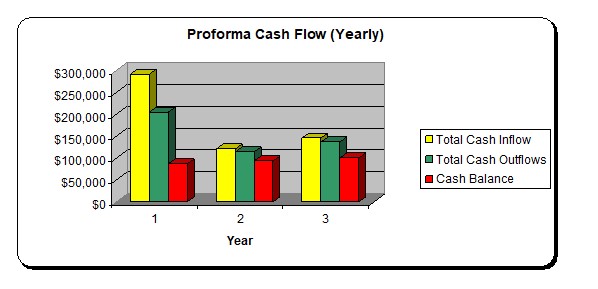

7.5 Cash Flow Analysis

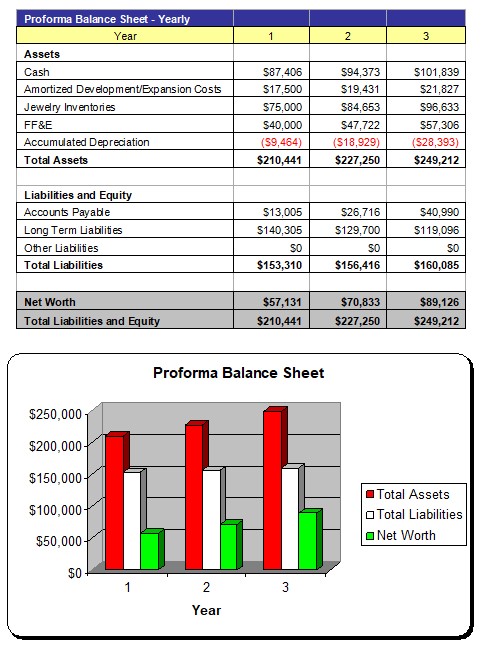

7.6 Balance Sheet

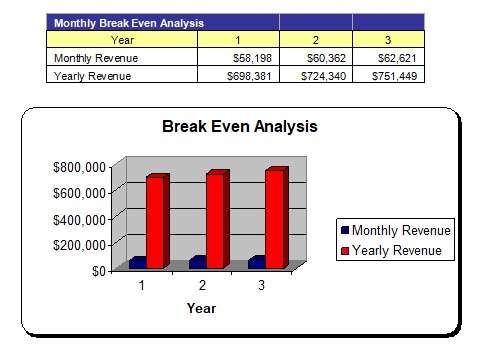

7.7 Breakeven Analysis

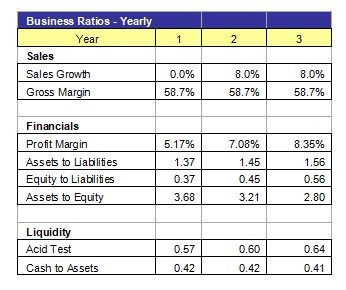

7.8 Business Ratios